Free accounting software? Yeah, it’s a thing, and it’s way more useful than you might think. Forget the stuffy spreadsheets and complicated software – there are tons of free options out there that can seriously simplify your financial life, whether you’re a freelancer hustling side gigs or running a small business. This guide dives into the best free options, compares them head-to-head, and helps you figure out if free is actually right for you.

We’ll cover everything from the top contenders and their killer features (and their not-so-killer limitations) to how they stack up against paid software. We’ll even tackle the security and privacy concerns, because, let’s be real, your financial data is precious. Get ready to level up your accounting game without breaking the bank.

Top Free Accounting Software Options

Choosing the right accounting software can be a game-changer for freelancers and small businesses. Finding a free option that fits your needs is even better, but it’s important to understand their limitations. This overview compares five popular free accounting software packages, highlighting their strengths and weaknesses to help you make an informed decision.

Free Accounting Software Comparison

This table compares five leading free accounting software packages based on their features, user interface, and ease of use. Remember that “free” often means limitations in features and scalability.

| Software Name | Key Features | Pros | Cons |

|---|---|---|---|

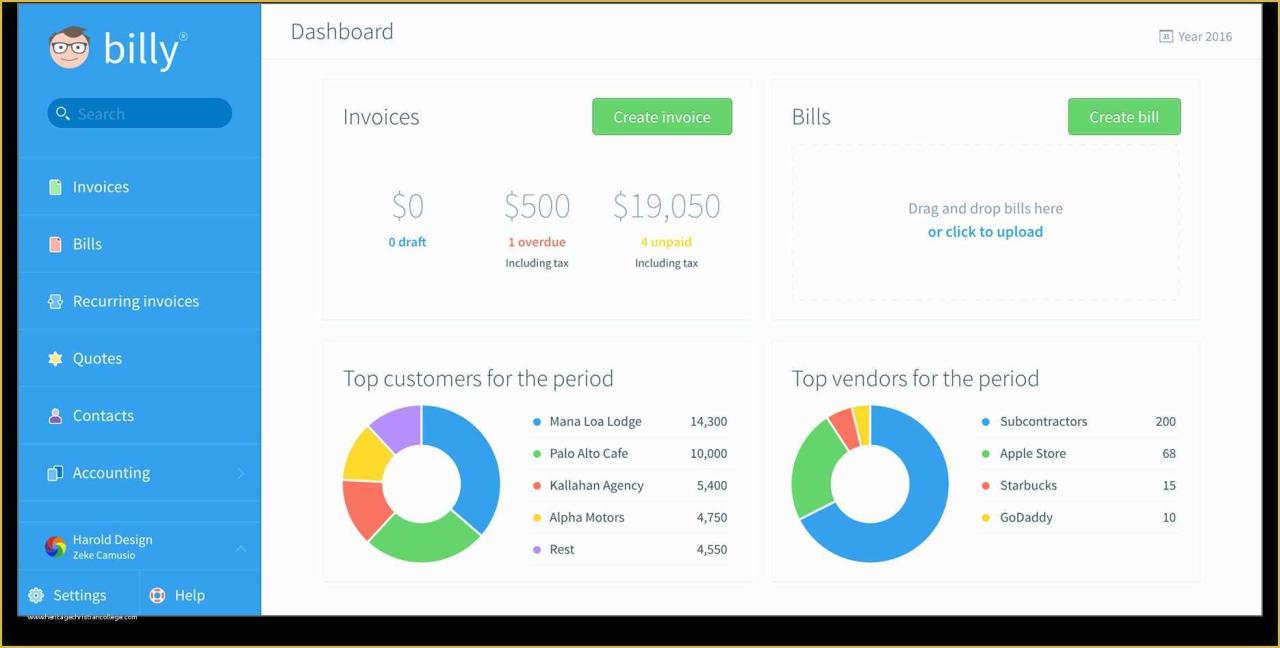

| Wave Accounting | Invoicing, expense tracking, receipt scanning, basic financial reporting, payment processing (with fees) | User-friendly interface, robust invoicing features, integrates with other tools. Great for freelancers and small businesses. | Limited inventory management, no advanced reporting features, payment processing fees can add up. More complex accounting tasks might require a paid plan. |

| ZipBooks | Invoicing, expense tracking, time tracking, client management, basic financial reporting | Intuitive interface, good for managing client projects, offers a clean and simple approach to accounting. | Limited inventory management, lacks robust reporting capabilities compared to paid versions. Advanced features are behind a paywall. |

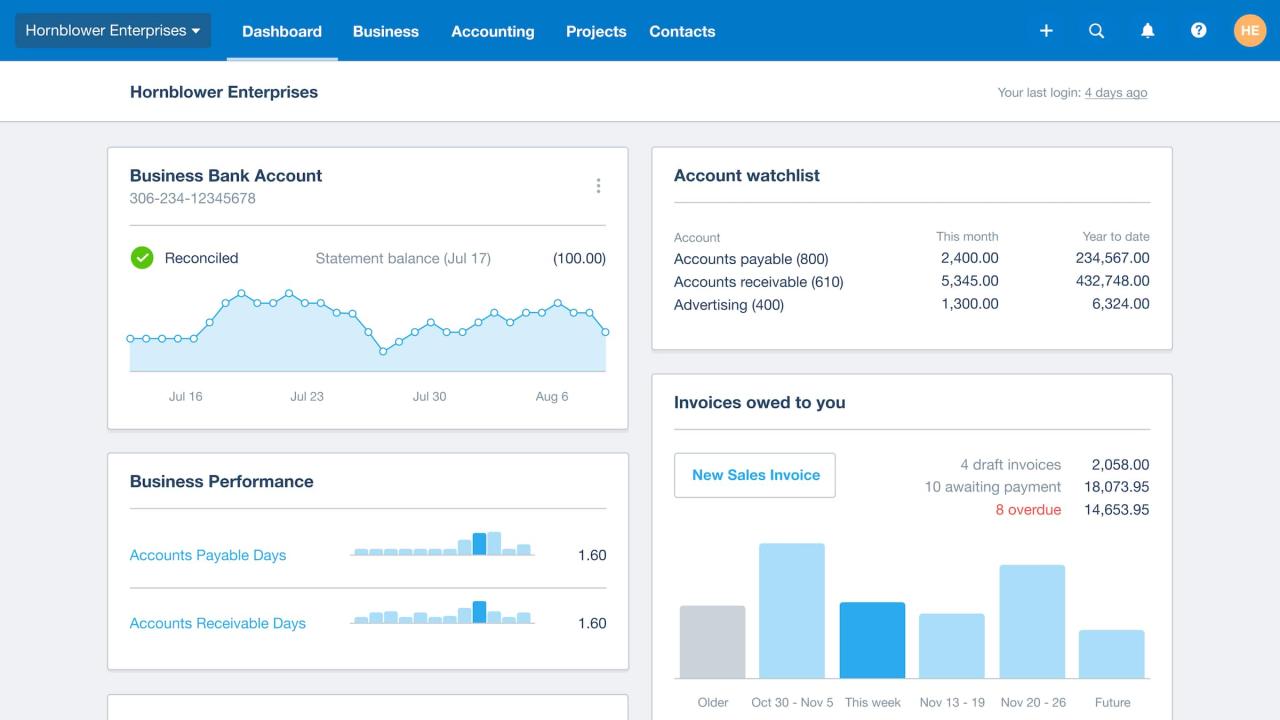

| Xero (Free Trial, then Paid) | Invoicing, expense tracking, bank reconciliation, inventory management (limited in free trial), reporting. Note: Xero is primarily a paid software, but offers a free trial. | Powerful features, integrates well with other business apps, strong reporting capabilities (in paid version). | Free trial is limited in time and functionality. Most robust features require a paid subscription. May be overkill for very basic needs. |

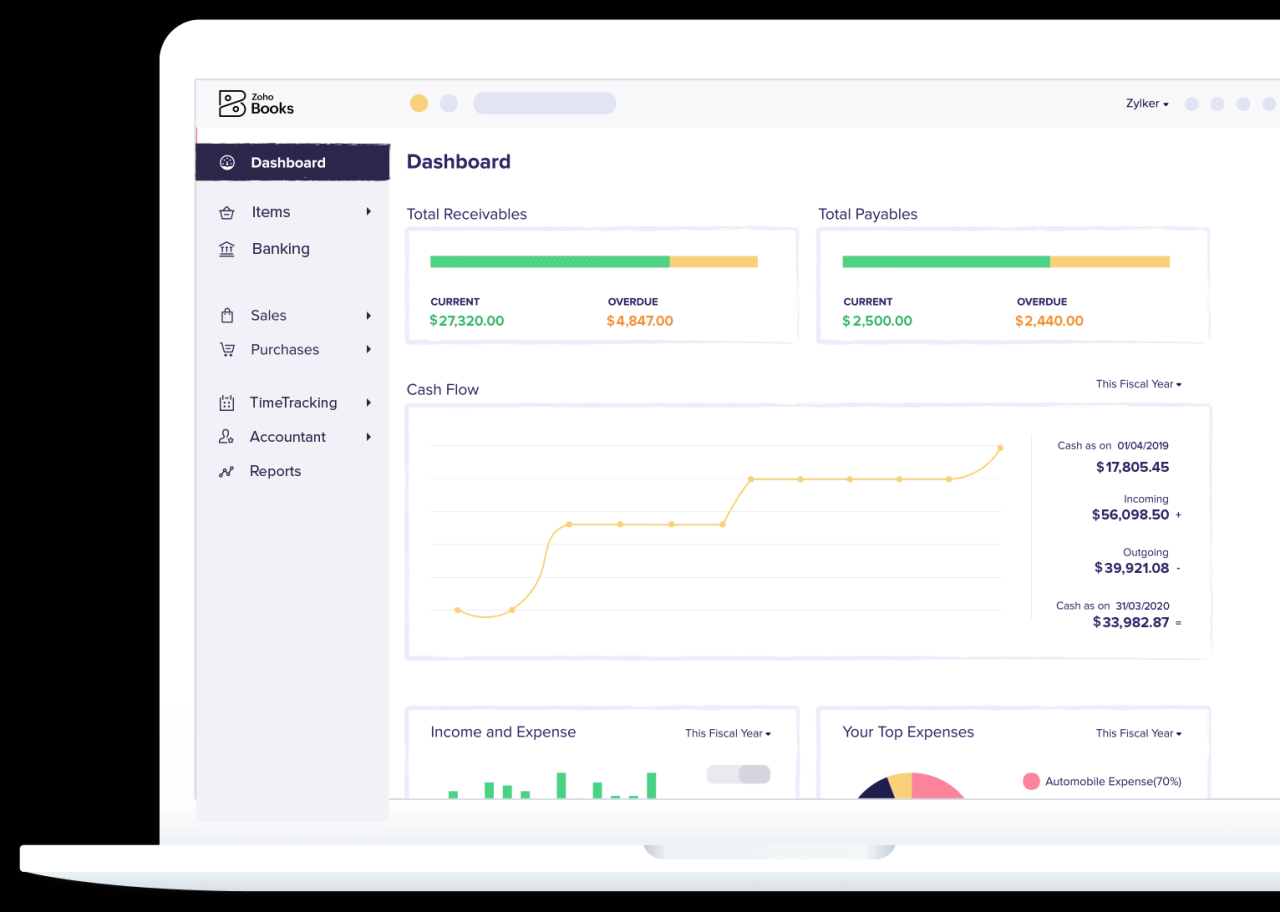

| Zoho Books (Free Plan, then Paid) | Invoicing, expense tracking, inventory management (limited in free plan), basic reporting, time tracking. Note: Zoho Books offers a free plan with limitations. | Comprehensive features for a free plan, good for growing businesses. Relatively easy to use. | Free plan limits the number of clients and transactions. Advanced features, such as detailed financial reports and inventory management, require a paid subscription. |

| QuickBooks Online (Free Trial, then Paid) | Invoicing, expense tracking, bank reconciliation, inventory management (limited in free trial), reporting. Note: QuickBooks Online is primarily a paid software, but offers a free trial. | Industry standard, extensive feature set (in paid version), strong integrations. | Free trial is limited in time and functionality. Most features require a paid subscription. Can be complex for users unfamiliar with accounting software. |

Target Audiences for Each Software Package

Each software package caters to different user needs and business sizes.Wave Accounting is ideal for solopreneurs and freelancers needing basic invoicing and expense tracking. ZipBooks suits small businesses with a need for client management alongside basic accounting. Xero, Zoho Books, and QuickBooks Online, while offering free trials, are better suited for growing businesses that anticipate needing more advanced features as they scale, and are willing to transition to a paid plan.

Non-profits might find Wave or Zoho’s free plans helpful for basic financial tracking, though the limitations may become apparent quickly.

Limitations of Free Accounting Software

Free accounting software typically limits the number of transactions, users, and features available. Advanced reporting features, robust inventory management, and integrations with other business tools are usually reserved for paid plans. For example, while Wave offers payment processing, it charges a fee per transaction, which can quickly negate the cost savings of a free plan. Similarly, the free plans of Zoho Books and QuickBooks Online limit the number of clients and transactions you can process.

Free trials of Xero and QuickBooks Online provide a glimpse of the software’s capabilities, but the full functionality is only accessible through a paid subscription. Choosing a free plan requires careful consideration of your current and future accounting needs to avoid outgrowing the free version prematurely.

Feature Comparison

Okay, so you’ve checked out the top free accounting software options, right? Now let’s get real about the differences between free and paid versions. Choosing the right one depends heavily on your business needs and how much you’re willing to invest (or not!). The functionality and scalability are the biggest game-changers.The core differences between free and paid accounting software boil down to features and how much they can grow with your business.

Free options are great for getting your feet wet, but paid software often offers more robust tools and support as your business expands.

Functionality and Scalability Differences

Free accounting software typically offers basic features sufficient for small businesses with simple accounting needs. Think of it as a starter kit. Paid software, on the other hand, often includes advanced features such as inventory management, project accounting, and more sophisticated reporting capabilities. Scalability is also a major factor; free software may struggle to handle the increased data volume and complexity of a rapidly growing business, whereas paid options are generally designed to adapt to expanding needs.

- Free Software: Limited features, basic reporting, suitable for small businesses with simple transactions, often capped on the number of transactions or users.

- Paid Software: Advanced features (inventory, payroll, project management), customizable reporting, scalability to handle large data volumes, often includes customer support.

Accounting Tasks Suited for Free vs. Paid Software

Choosing between free and paid software depends heavily on the complexity of your accounting tasks. Simple tasks like tracking income and expenses are easily handled by free software. However, more complex tasks, such as managing inventory, generating detailed financial reports, or integrating with other business software, typically require the capabilities of a paid solution.

- Free Software Ideal For: Sole proprietors, freelancers, or very small businesses with minimal transactions and simple accounting needs. Think basic income and expense tracking.

- Paid Software Ideal For: Businesses with complex accounting needs, multiple users, large transaction volumes, and the need for advanced reporting and analysis. Examples include businesses with inventory, multiple departments, or international operations.

Situations Where Free Software Could Be Detrimental

While free software is a great starting point, relying on it indefinitely can create significant problems for a growing business. Limited features can hinder efficient financial management, potentially leading to inaccurate reporting and missed tax deadlines. Lack of scalability can also cause significant issues as the business grows. Consider a rapidly growing e-commerce business using free software; it might struggle to manage the large number of transactions and inventory, potentially leading to stockouts or inaccurate financial statements.

The lack of robust reporting tools can make it difficult to make informed business decisions. Furthermore, limited customer support can leave you struggling to resolve critical issues independently.

- Example 1: A rapidly growing e-commerce business exceeding the transaction limits of free software, leading to incomplete financial records and potential tax penalties.

- Example 2: A small business owner using free software without inventory tracking, leading to inaccurate stock levels and lost sales opportunities.

Integration Capabilities of Free Accounting Software

Choosing free accounting software often involves considering its ability to connect with other tools you use. Seamless integration can significantly streamline your business operations, saving you time and reducing the risk of errors. However, it’s important to understand the types of integrations available and their potential impact on your workflow.Integration options vary widely depending on the specific software.

Some packages offer more robust integration capabilities than others, and the extent of these features often correlates with the software’s overall functionality and pricing (even if it’s free!). Understanding these differences is crucial for selecting the right tool for your business needs.

Bank Feeds and Payment Gateways

Bank feeds automatically import transaction data from your bank accounts into your accounting software. This eliminates manual data entry, a major time-saver for businesses of all sizes. Payment gateways, on the other hand, allow you to process online payments directly through your accounting software. This integration ensures that all payment information is automatically recorded, improving accuracy and reducing reconciliation efforts.

For example, a small business using Wave Accounting might connect its bank account and Square payment processor to automatically track all income and expenses. This automated process prevents discrepancies between bank statements and the accounting software.

CRM System Integration

Integrating your accounting software with a Customer Relationship Management (CRM) system can create a more holistic view of your business. This allows you to track customer interactions, sales, and payments all in one place. For instance, if you use Zoho CRM and Xero (even though Xero isn’t strictly free, it offers a free trial), integrating them allows you to see which customers have outstanding invoices and manage their accounts more efficiently.

This combined view eliminates the need to switch between different platforms to get a complete picture of your customer relationships and their financial status. However, the level of integration varies; some integrations might only allow for basic data syncing, while others offer more advanced features like automated invoice generation from CRM data.

Benefits and Drawbacks of Integration

Integrating your free accounting software with other business tools offers significant benefits. Automation reduces manual data entry, saving time and minimizing errors. A unified view of your business data improves decision-making by providing a more complete picture of your finances and customer interactions. Improved efficiency translates directly to cost savings and increased productivity.However, integrations aren’t without drawbacks.

Some integrations might require technical expertise to set up and maintain. Data security is also a concern; ensure the integration you choose uses secure protocols to protect sensitive information. Furthermore, relying heavily on integrations can create a dependency; if one system fails, it can disrupt your entire workflow. It’s crucial to thoroughly research and understand the potential risks before integrating your software.

Hypothetical Workflow: Small Business Financial Management

Imagine Sarah, owner of a small online bakery. She uses a free accounting software package with bank feed integration, a payment gateway (like Stripe), and a simple CRM. Each morning, Sarah checks her accounting software. Bank feeds automatically update her account balances and transaction history. She reviews sales data from the previous day, automatically recorded via the payment gateway.

Using her CRM, she identifies customers with overdue invoices and sends automated reminders. She generates reports on her bakery’s profitability and cash flow with ease, all within the same software. This streamlined workflow saves her significant time and effort compared to manual data entry and juggling multiple software programs. Sarah can focus on baking delicious treats instead of wrestling with spreadsheets.

Security and Data Privacy in Free Accounting Software

Choosing free accounting software often involves a trade-off: access to helpful tools versus concerns about data security and privacy. While many free options offer robust features, understanding the security measures and privacy policies of each provider is crucial before entrusting your financial information. This section explores the security practices and data privacy policies of several popular free accounting software options.

Data Security Measures in Popular Free Accounting Software

Free accounting software providers employ various security measures to protect user data. These typically include data encryption during transmission and storage, robust access controls limiting who can view and modify data, and regular security audits to identify and address vulnerabilities. However, the specific implementations and strengths of these measures vary significantly between providers. Some utilize industry-standard encryption protocols like AES-256, while others may rely on less robust methods.

The frequency and comprehensiveness of security audits also differ, impacting the overall security posture. Furthermore, the location of data storage – whether within the provider’s own servers or a third-party cloud service – also influences the level of security.

Comparison of Data Privacy Policies

Analyzing the data privacy policies of different free accounting software providers reveals significant differences in their approaches to data handling and user consent. Some providers are transparent about their data collection practices and offer granular control over user data, allowing users to specify what information is collected and how it is used. Others may have less transparent policies, collecting more data without explicit user consent.

The extent to which user data is shared with third parties, such as marketing partners or analytics firms, also varies considerably. It’s important to carefully review each provider’s privacy policy before making a decision.

Data Security and Privacy Comparison Table

| Software Name | Data Encryption Methods | Data Storage Location | Privacy Policy Highlights |

|---|---|---|---|

| Wave Accounting | AES-256 encryption for data in transit and at rest (according to their website) | Their own servers and cloud infrastructure (specific details not publicly available) | Clearly states data usage for service provision and compliance, commitment to GDPR and CCPA compliance. Details on data retention and user rights are provided. |

| Zoho Books (Free Plan) | Uses SSL/TLS encryption for data in transit and claims to use encryption for data at rest, but specific details are not readily available on their public facing pages. | Zoho’s cloud infrastructure. | Highlights data processing activities, data retention policies, and user rights, including the right to access, rectify, and erase personal data. Specifics on third-party data sharing are less detailed than Wave. |

| Xero (Free Trial, then Paid) | Employs industry-standard encryption protocols for data in transit and at rest (details not publicly specified). | Their secure cloud infrastructure (details not publicly available). | Comprehensive privacy policy addressing data collection, processing, security, and user rights. They emphasize compliance with various data protection regulations. Note that this is for the trial, which is not strictly “free” long-term. |

User Reviews and Testimonials of Free Accounting Software

Online reviews offer valuable insights into the real-world experiences of users with free accounting software. Analyzing these testimonials helps potential users understand the strengths and weaknesses of different options before committing to a particular platform. By examining common themes and specific examples, we can gain a clearer picture of user satisfaction and identify which software best meets the needs of various users.

User reviews from reputable platforms like Capterra, G2, and TrustRadius provide a wealth of information. These sites aggregate reviews from verified users, allowing for a more comprehensive understanding of user sentiment than relying on individual testimonials. We will focus on three popular free accounting software options to illustrate the diversity of user experiences.

User Reviews for Wave Accounting

Wave Accounting consistently receives high praise for its user-friendly interface and robust feature set for a free platform. Many users appreciate its intuitive design, making it easy to navigate even without prior accounting experience. Positive reviews frequently highlight the ease of invoicing, expense tracking, and report generation. However, some users report limitations with the free plan, particularly concerning the lack of advanced features and support for larger businesses.

For example, one user noted frustration with the lack of inventory management capabilities, while another mentioned difficulties in integrating with their existing CRM. Conversely, a positive review described how Wave’s simple interface allowed a small business owner to easily track their income and expenses, significantly improving their financial organization.

User Reviews for Xero (Free Trial)

While Xero itself is a paid software, it offers a free trial period allowing users to experience its features. Reviews during the trial period often focus on the software’s comprehensive functionality and advanced features not available in many free options. Users praise Xero’s strong bank reconciliation tools, its mobile app, and the overall professional look of its reports. Negative feedback often centers on the trial’s limited duration and the cost of the paid version, which can be prohibitive for some small businesses.

A user commented on the ease of importing bank transactions and the accuracy of the automated reconciliation process, contrasting this positively with their previous manual methods. Another user expressed disappointment that the free trial didn’t allow access to all features, leading to an incomplete understanding of the software’s capabilities before committing to a subscription.

User Reviews for Zoho Books (Free Plan)

Zoho Books’ free plan caters to small businesses, offering a range of features including invoicing, expense tracking, and basic reporting. User reviews generally highlight the software’s affordability and comprehensive feature set within the constraints of a free plan. Positive reviews often mention the software’s integration capabilities with other Zoho applications, a significant advantage for users already within the Zoho ecosystem.

However, some users report limitations with customer support and occasional glitches within the software. One user lauded the ease of generating professional-looking invoices, while another criticized the lack of detailed reporting compared to paid versions. A common theme in negative reviews is the feeling that the free plan is too limited for businesses that experience rapid growth or require advanced features.

Free Accounting Software for Specific Industries

Free accounting software offers a great starting point for many businesses, but its suitability varies greatly depending on the industry. Some industries have more complex accounting needs than others, requiring specialized features or integrations not always found in free options. Let’s explore how free software can be a good fit for some, while highlighting situations where paid software might be necessary.

Free Accounting Software for the Freelance/Consulting Industry

Many freelancers and consultants find free accounting software perfectly adequate for their needs. Their financial transactions are often simpler than those of larger businesses, involving invoicing clients, tracking expenses, and managing income. Software like Wave Accounting is a popular choice for this group, offering free invoicing, expense tracking, and basic reporting features. Its simplicity and ease of use make it a great fit for individuals without extensive accounting expertise.

However, as a freelancer’s business grows and involves more complex tax situations or multiple projects with varying payment schedules, they might need to upgrade to a paid version with more robust features, such as advanced reporting and project management tools.

Free Accounting Software for the Retail Industry (Small Businesses)

Small retail businesses can also benefit from free accounting software, particularly those with straightforward inventory management. Software like Zoho Books offers a free plan with features such as inventory tracking, sales management, and basic accounting functions. This is helpful for managing sales, purchases, and stock levels, especially for smaller retailers with a limited product range. However, for larger retail operations with numerous SKUs, complex inventory management requirements (like lot tracking or serial numbers), or advanced point-of-sale (POS) system integration, the limitations of free software quickly become apparent.

The need for robust inventory tracking and reporting, coupled with the complexities of managing sales tax and returns, would often necessitate the transition to a paid, more feature-rich solution.

Free Accounting Software for the Non-Profit Sector

Non-profit organizations often rely heavily on donations and grants, making accurate financial tracking crucial. Free software like Xero (which offers a limited free trial, not a fully free plan, but is worth mentioning due to its popularity in the non-profit sector) can help manage donations, track expenses, and generate reports needed for grant applications and audits. While the basic features of many free accounting software options can manage simple donation processing and expense tracking, the need for compliance with specific non-profit accounting standards and the generation of detailed financial reports for donors and regulatory bodies often leads non-profits to invest in paid software that offers specialized features and greater reporting capabilities.

The increased audit scrutiny and the importance of transparency in the non-profit sector often justify the cost of more comprehensive accounting software.

Choosing the Right Free Accounting Software

Picking the perfect free accounting software can feel overwhelming, but it doesn’t have to be! This step-by-step guide will help you navigate the options and find the best fit for your business’s specific needs. Remember, “free” doesn’t mean “low quality”—many excellent options are available, but finding the right one requires careful consideration.

Assessing Your Business Needs

Before diving into software features, take time to understand your business’s accounting requirements. Consider your current financial processes, the size of your business (sole proprietorship, small business, etc.), and your future growth plans. For example, a freelancer might need simple invoicing and expense tracking, while a growing retail business may require inventory management and more advanced reporting capabilities. Knowing your needs helps narrow down the software options significantly.

Creating a Feature Checklist

Now, it’s time to create a checklist of essential features. This will serve as your guide when comparing different software packages. Consider these key aspects:

- Invoicing: Does the software allow for easy invoice creation, sending, and tracking of payments? Consider features like customizable templates and automated reminders.

- Expense Tracking: Can you easily categorize and track expenses? Look for features like receipt scanning and integration with bank accounts.

- Financial Reporting: What kind of reports do you need? Profit and loss statements, balance sheets, and cash flow reports are standard, but some businesses may need more specialized reports.

- Inventory Management: If you sell products, you’ll need a system to track inventory levels, costs, and sales. Consider features like low-stock alerts and automated reordering.

- Payroll: Does the software handle payroll processing? This is a crucial feature for businesses with employees, but often a premium feature in free options.

- Bank Reconciliation: The ability to easily reconcile your bank statements with your accounting records is essential for accuracy.

Comparing Software Options Based on Your Checklist

With your checklist in hand, start researching free accounting software options. Many websites offer comparison charts that highlight key features. Focus on the features that are most important to your business based on the assessment you conducted earlier. Don’t get bogged down in features you won’t use. For example, if you’re a solopreneur, advanced inventory management might be unnecessary.

Testing the Software (Trial Period or Demo), Free accounting software

Most free accounting software offers a trial period or a demo version. Take advantage of this! Import some sample data to test the software’s usability and features. See how easy it is to navigate the interface, create invoices, track expenses, and generate reports. This hands-on experience will help you determine if the software is a good fit for your workflow.

Considering Integration Capabilities

Check if the software integrates with other tools you use, such as your bank accounts, payment processors, or CRM. Seamless integration can significantly streamline your workflow and save you time. For instance, automatic bank feed integration can save hours of manual data entry.

Evaluating Security and Data Privacy

Security and data privacy are paramount. Look for software that employs robust security measures, such as data encryption and two-factor authentication. Read reviews and check the company’s privacy policy to ensure your financial data is protected. For example, look for mentions of compliance with standards like SOC 2.

Reviewing User Feedback

Before making a final decision, read user reviews and testimonials. Pay attention to comments about ease of use, customer support, and the software’s overall reliability. User feedback can provide valuable insights that go beyond the software’s features.

The Limitations of Free Accounting Software

Okay, so you’ve been using free accounting software, and it’s been great for getting your feet wet. But like, everything has a downside, right? Free accounting software is awesome for bootstrapping, but there are definite limitations you need to be aware of before you find yourself stuck in a situation you can’t easily fix. Understanding these limitations will help you decide if it’s time to level up to a paid solution.Free accounting software often comes with a bunch of restrictions that can seriously impact your business as it grows.

Think of it like this: a free bicycle is great for short trips, but you wouldn’t try to cross the country on it, would you? Similarly, free accounting software is perfect for simple bookkeeping needs, but as your business expands, its limitations become increasingly apparent. This usually manifests in a few key areas: restricted features, limited support, and scalability problems.

Restricted Features

Many free accounting software options offer a stripped-down version of their paid counterparts. You might find yourself missing key features like advanced reporting, inventory management, or robust payroll capabilities. For example, a small bakery using free software might struggle to track ingredient costs effectively, impacting profitability analysis. They might also be limited in their ability to generate comprehensive reports for tax preparation or investor presentations.

This lack of functionality can hamper efficient operations and informed decision-making.

Limited Support

Let’s face it, tech issues happen. With free software, you’re often left to fend for yourself. Support is usually minimal, consisting of FAQs and online forums. This can be a huge time suck when you encounter a problem that prevents you from completing crucial tasks. Imagine your business’s bank reconciliation process being stalled due to a software glitch, and you’re unable to get timely assistance.

The lost time and potential errors could cost you significantly more than the cost of a paid subscription.

Scalability Issues

Free accounting software isn’t designed to handle massive amounts of data. As your business grows, you’ll likely encounter slow processing speeds, data storage limitations, and difficulties managing multiple users. A rapidly expanding e-commerce business, for example, could quickly outgrow the capacity of free software, leading to system crashes and potential data loss. The cost of fixing these issues, in terms of lost time and potential data recovery, far outweighs the cost of investing in scalable paid software from the outset.

Factors Indicating a Need for Upgrading

Several factors can signal that it’s time to ditch the free software and upgrade to a paid solution. These include needing more advanced reporting features, experiencing frequent software glitches, struggling with slow processing speeds, needing better customer support, requiring integration with other business applications, or noticing a significant increase in the volume of transactions. If any of these situations are impacting your efficiency or putting your data at risk, it’s a strong indication that a paid accounting software is a worthwhile investment.

The cost of the software pales in comparison to the potential cost of errors, lost productivity, and compromised data security.

Illustrative Examples of Free Accounting Software Use Cases

Free accounting software offers a powerful tool for small businesses and freelancers to manage their finances efficiently. The right software can streamline processes, improve accuracy, and save valuable time and money. The following examples illustrate how different businesses can leverage these tools for success.

Freelance Graphic Designer Utilizing Wave Accounting

Sarah, a freelance graphic designer, uses Wave Accounting to manage her invoices, expenses, and taxes. Wave’s free plan provides ample functionality for her needs. She creates and sends professional-looking invoices directly through the software, tracks her income effortlessly, and categorizes expenses for accurate tax reporting. The software’s intuitive interface allows her to quickly reconcile her accounts and generate financial reports.

So you’re looking at free accounting software to manage your finances, right? That’s smart! But if you’re also working on a big project using revit , you’ll need software that can handle both the creative and financial aspects. Finding the right free accounting software can be a game-changer, ensuring you stay on top of your budget alongside your awesome designs.

It’s all about finding the right tools for the job!

Wave’s automated features, such as recurring invoices, further streamline her workflow. A limitation Sarah initially faced was the lack of advanced inventory management, which isn’t crucial for her business model, but if she expands to selling merchandise, she might need to upgrade or explore a different solution. However, for her current needs, Wave’s free features are perfectly sufficient.

Small Retail Business Using Gnucash

John owns a small bookstore. He uses Gnucash, a free and open-source accounting software, to manage his inventory, sales, and expenses. Gnucash’s double-entry bookkeeping system allows John to maintain accurate financial records. He uses the inventory tracking feature to monitor stock levels, ensuring he doesn’t overstock or run out of popular titles. The reporting features help him analyze sales trends and identify best-selling items.

Gnucash’s flexibility allows him to customize his chart of accounts to fit his specific business needs. A limitation John encountered was the steeper learning curve compared to more user-friendly options. However, he found numerous online resources and tutorials that helped him master the software. The initial investment of time learning the software was offset by the long-term benefits of accurate financial tracking and reporting.

Online Tutor Utilizing Zoho Books

Maria, an online tutor, utilizes Zoho Books to manage her client billing and expenses. Zoho Books’ free plan provides tools for creating and sending invoices, tracking payments, and managing expenses. She appreciates the software’s ability to automate recurring invoices for her regular clients. The expense tracking feature helps her categorize her business-related expenses, making tax preparation much simpler.

Zoho Books’ mobile app allows her to access her financial data from anywhere, making it convenient to manage her finances on the go. A limitation Maria found was the free plan’s limited number of invoices she could generate per month. She needed to keep a close eye on her invoice count, and occasionally had to prioritize which clients she invoiced through Zoho Books versus sending invoices manually.

This limitation, however, was not overly problematic, and the benefits of the software outweighed this minor inconvenience.

Last Word

So, there you have it – a deep dive into the world of free accounting software. While it might not be the perfect fit for every business, it offers a fantastic starting point for many. By carefully considering your needs, comparing features, and understanding the limitations, you can find a free solution that helps you manage your finances effectively.

Remember to prioritize security and regularly evaluate whether your chosen software continues to meet your evolving needs. Happy accounting!

Clarifying Questions

What’s the catch with free accounting software?

The main catch is usually limitations on features, like fewer users, less robust reporting, or limited customer support. Think of it as a trial run before you commit to a paid version.

Can I use free accounting software for my taxes?

Most free software can generate reports useful for tax preparation, but you’ll likely still need tax software or a professional to file your actual return. The free software helps organize your data.

Is free accounting software secure?

Reputable free accounting software providers employ security measures like data encryption and secure servers. However, always research the specific provider’s security policies before using their software.

What happens if my business grows and I outgrow free software?

Many free options offer paid upgrades with expanded features and support. If your business expands beyond the capabilities of your free software, upgrading is a smooth transition.

How do I choose the right free accounting software for my needs?

Consider your industry, the size of your business, the number of transactions you process, and the specific features you need (like invoicing, expense tracking, or bank reconciliation). Then, compare options based on those priorities.